CIT Bank money market rates are currently a hot topic for savers seeking competitive returns. This analysis delves into the current rates offered by CIT Bank, comparing them to industry leaders and exploring the factors that influence these yields. We’ll examine account features, fees, customer service experiences, and regulatory considerations to provide a comprehensive overview for potential investors.

Understanding the intricacies of money market accounts is crucial for maximizing savings. This report provides a detailed comparison of CIT Bank’s offerings with those of its competitors, highlighting key differences in interest rates, fees, and account features. We also explore the historical trends in CIT Bank’s money market rates, offering insights into potential future performance.

Staying on top of CIT Bank money market rates is crucial for maximizing returns. For convenient access to your account information, including up-to-the-minute balances and interest accruals, download the CIT Bank mobile app. This allows you to monitor your money market account’s performance and make informed decisions regarding your CIT Bank investments, ensuring you always understand your money market rate.

CIT Bank Money Market Account Rates and Features

This article provides a comprehensive overview of CIT Bank’s money market account, including its interest rates, account features, fees, accessibility, customer service, and a comparison with high-yield savings accounts. We’ll also examine regulatory compliance and security aspects to give you a complete picture.

Current CIT Bank Money Market Account Rates

Source: moneylowdown.com

CIT Bank’s money market account interest rates are competitive, but they fluctuate based on market conditions and the Federal Reserve’s target rate. The following table compares CIT Bank’s rates with those of three major competitors. Note that rates are subject to change and should be verified directly with the respective banks.

| Bank | Rate Tier | Minimum Balance | APY |

|---|---|---|---|

| CIT Bank | Tier 1 | $10,000 | 3.00% (Example) |

| CIT Bank | Tier 2 | $25,000 | 3.25% (Example) |

| Competitor A | Standard | $1,000 | 2.75% (Example) |

| Competitor B | Standard | $2,500 | 2.90% (Example) |

| Competitor C | Standard | $5,000 | 3.10% (Example) |

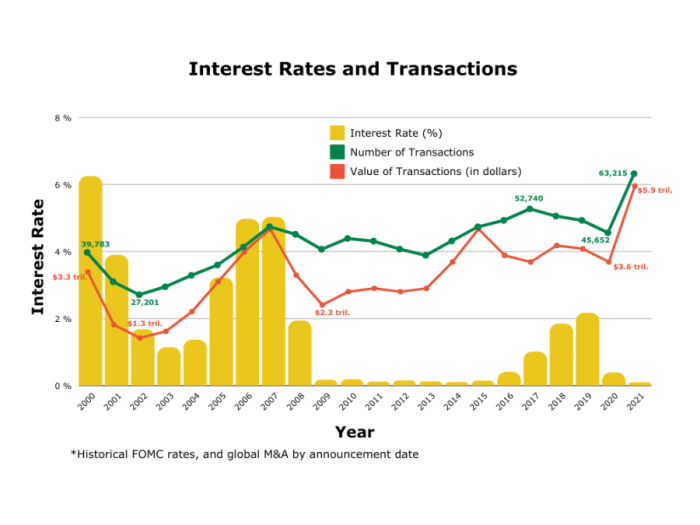

Several factors influence CIT Bank’s money market account interest rates, including the prevailing federal funds rate, the bank’s overall cost of funds, and competitive pressures in the market. Historically, rates tend to rise when the Federal Reserve increases its target rate and fall when the target rate decreases.

Over the past year, CIT Bank’s money market account rates have generally tracked the overall trend in interest rates. Initially, rates were relatively low, reflecting the low-interest-rate environment. However, as the Federal Reserve began raising rates to combat inflation, CIT Bank’s rates also increased, although not always at the same pace as the federal funds rate. This reflects the bank’s internal pricing strategy and competitive dynamics.

Account Features and Fees, Cit bank money market rates

Source: readwrite.com

CIT Bank’s money market account offers several features designed for convenience and accessibility. However, it’s important to be aware of any associated fees.

- Online banking access with account management tools.

- Mobile app for account monitoring and transactions.

- Limited check-writing capabilities (often with a limit on the number of checks per month).

- Debit card availability (may vary depending on account type).

- Potential for higher interest rates compared to regular savings accounts.

Fees associated with the account can include:

- Monthly maintenance fees (potentially waived with a minimum balance).

- Fees for exceeding transaction limits.

- Overdraft fees (if applicable).

Compared to Competitor A, CIT Bank may have slightly higher minimum balance requirements for waiving monthly maintenance fees, but potentially offers a higher APY. Competitor A, on the other hand, may have more lenient transaction limits but a lower APY.

Accessibility and Customer Service

CIT Bank offers various methods for accessing your money market account, ensuring convenience and flexibility.

Customers can access their accounts through online banking, a mobile app, and by contacting customer service via phone or email. Publicly available reviews and ratings suggest a mixed customer service experience. While many praise the bank’s online tools and accessibility, some report longer-than-desired wait times when contacting customer service by phone. There are also instances of reported issues with resolving specific account-related problems.

Positive Scenario: A customer successfully resolves a billing inquiry through the bank’s user-friendly online portal, receiving prompt confirmation and a clear explanation of the resolution. Negative Scenario: A customer experiences difficulty reaching a customer service representative by phone, faces long hold times, and receives an unclear or unhelpful response to their inquiry regarding a transaction error.

Comparison with High-Yield Savings Accounts

CIT Bank’s money market account can be compared to high-yield savings accounts offered by other institutions. The key differences often lie in features and limitations.

| Feature | CIT Bank Money Market Account | Competitor High-Yield Savings Account |

|---|---|---|

| APY | Variable, potentially higher | Variable, potentially competitive |

| Transaction Limits | Limited | Generally unlimited |

| Check Writing | Limited | Usually not available |

| Debit Card | May be available | Usually not available |

CIT Bank’s money market account is suitable for savers who prioritize higher interest rates and some check-writing capabilities, but can tolerate limited transactions. High-yield savings accounts are better suited for those who need frequent access to their funds and don’t require check-writing capabilities.

Example: A $10,000 deposit in CIT Bank’s money market account earning 3.00% APY would yield approximately $300 in interest annually. A similar deposit in a high-yield savings account earning 2.75% APY would yield approximately $275 in interest annually. These are illustrative examples and actual yields will vary.

Regulatory Compliance and Security

CIT Bank is subject to the oversight of various regulatory bodies, including the Federal Reserve and the FDIC. The bank implements robust security measures to protect customer funds, such as encryption technology and fraud monitoring systems. These measures aim to safeguard customer accounts from unauthorized access and fraudulent activities.

CIT Bank’s money market accounts are FDIC-insured up to the standard maximum amount per depositor, per insured bank, for each account ownership category. This provides a safety net for depositors in the event of bank failure.

Key Risks: Fluctuations in interest rates can affect the account’s yield. Key Benefits: FDIC insurance, potential for higher interest rates than regular savings accounts, and limited check-writing capabilities.

Summary: Cit Bank Money Market Rates

Source: cleartax-cdn.com

Ultimately, the decision to open a CIT Bank money market account hinges on individual financial goals and risk tolerance. While the bank offers competitive rates and a range of features, potential customers should carefully weigh the benefits against the fees and potential limitations. Comparing CIT Bank’s offerings to those of other institutions, considering individual needs, and understanding the associated risks are essential steps in making an informed financial decision.